The Evolution of Wealth Management in Canada

Like virtually every other industry, the Wealth Management industry in Canada has evolved over the past number of decades.

In the 70s and into the 80s, most people invested/saved through Canada Savings Bonds (CSBs) and simple bank deposits. These savings bonds were paying double digit interest rates that peaked in 1981 when CSBs were paying an annual interest rate of 19.50% and the 1st $1,000 of interest earned was tax free. Guaranteed Investment Certificates (GICs) were also extremely popular. In 1981 an investor could choose the term of their GIC from 1 to 5 years with the GIC paying a guaranteed interest rate of 20.5% or more per year.

However, as interest rates began to decline over the past few decades to some of the lowest levels in history (the interest rate on a 1 year CSB issued between Oct. 3 and Nov. 1/15 = 0.80% while 1 Year GICs are paying less than 2% and 5 Year GICs are paying approximately 2.5% as at October of 2016), these investments lost their attraction.

As interest rates began their long decline, the popularity of mutual funds began to rapidly replace CSBs and GICs. The largest influx into mutual funds in Canada came during the 1990s when double-digit interest rates that had lured investors into CSBs and GICs tumbled and investors moved into investments with the potential for higher returns. The growth of mutual funds and their impact on investing in general was nothing short of revolutionary. For the first time ordinary investors with minimal amounts to invest could pool their resources in a professionally managed, diversified basket of investments. This was considered a giant step in the democratization of investments for the average person.

Mutual funds were very popular for the average retail investor, however, for the industry titans who made their money in heavy industry and otherwise, they hired professional money managers to oversee and grow their wealth. Likewise, large pension plans, endowments and other institutional investors entrusted their assets to professional money-management firms. With minimum investment requirements of $1 Million or more, the services of these money managers have historically been well out of reach of the average investor.

Over time, investors saw the benefits of professional money management and wanted access to those benefits. The rise of the mutual fund industry partially met that need by enabling investors to pool their assets and create portfolios large enough to attract professional money-management firms.

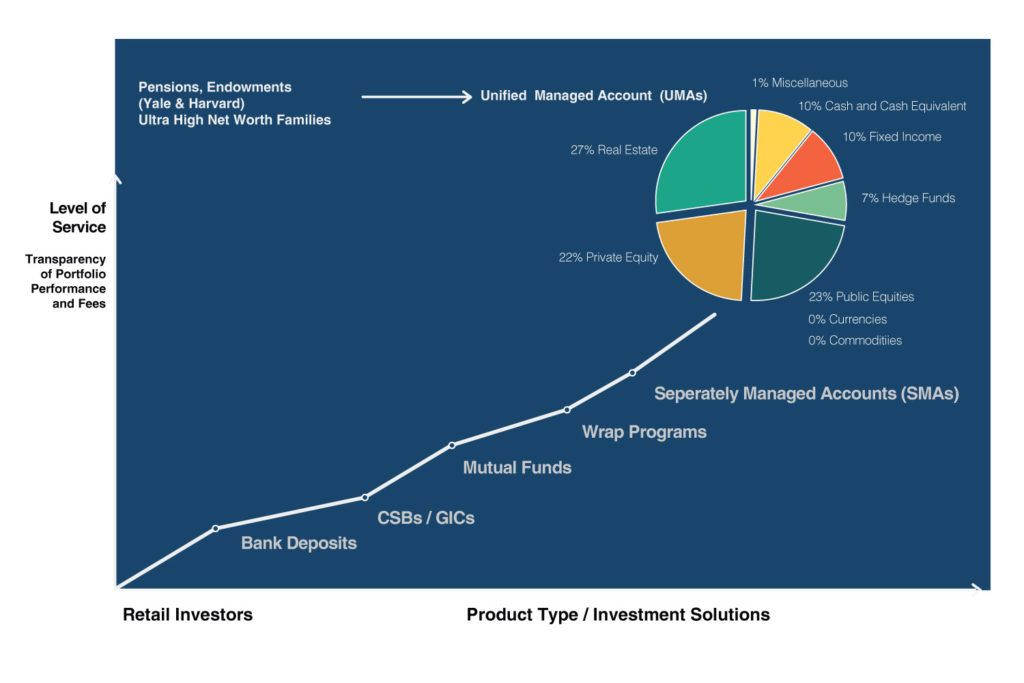

However, the investment management industry was divided into retail and institutional investors. On one side were the traditional products designed for middle-income individual investors like mutual funds. On the other side were managed strategies for institutions with imposing minimums. In between these, however, is the growing universe of Separately Managed Accounts (SMAs) targeted at wealthy (but not necessarily ultra-wealthy) individual investors.

Due to technological advancements, money-management firms have been able to significantly reduce their minimum investment requirements to well below the traditional $1 Million level. Therefore, instead of pooling their assets with those of other investors into one-size-fits-all or many-sizes-fit-many portfolios, far more investors were able to access the benefits of customized portfolio management via SMAs.

There are many significant advantages of Separately Managed Accounts over Mutual Funds which will be outline elsewhere. However, SMAs were not the ultimate panacea of investing. Although many consider SMAs superior to mutual funds, SMAs were not without their limitations.

Congratulations if you have made the leap from mutual funds to SMAs, however, there may be some things that you haven’t considered. For example, your Portfolio Manager likely provides excellent reporting regarding your returns against the benchmarks that they are compared against; however, do you know how they are doing versus other Portfolio Managers. Also, many Portfolio Managers (PMs) have an expertise in a specific area because no portfolio manager can be expert in all areas. Therefore, sometimes SMA portfolios don’t provide as broad a diversification model as some investors require. It can be beneficial to combine the different areas of expertise and experience of different portfolio managers into a Unified Managed Account that is overseen by an objective, unbiased party.

For example, like a well diversified pension fund or endowments, investors who are able to satisfy the minimums required in order to have an effectively and efficiently diversified portfolio may require expertise in the following asset classes:

- North American Dividend Growth stocks

- European Dividend Growth stocks

- Emerging Markets Dividend Growth stocks

- Small Cap stocks both domestic and global

- Options

- Fixed Income both domestic and global

- Exchanged Traded Funds (ETFs)

- Alternative Investments like income producing real estate, private equity and hedge funds – this is an area that pension plans and endowments have used successfully for decades to diversify away from the volatility of the public stock and bond markets

Therefore, depending on the size of an individual’s or family’s portfolio, as well as their goals, objectives and risk tolerance, the services and expertise of as many as 3 or 4 PMs with different areas of expertise could be incorporated into the construction of their tailor made portfolio.

This is where Evolution Private Wealth Management Solutions can add value to High Net Worth Investors. We take the time to understand the unique circumstances and objectives of our clients in order to ensure that their needs are satisfied and their concerns are addresses. Our experience and research tells us that most High Net Worth individuals have many of the same concerns including:

- Understanding their risk tolerance

- Knowing exactly how much they are paying for wealth management services

- Ensuring they are obtaining the best risk-adjusted rates of return required in order to ensure their financial objectives are accomplished

- Ensuring that assets last for their lifetime while being able to afford their desired lifestyle in retirement

We monitor the PMs involved with each client’s portfolios to ensure that they are maintaining their discipline regarding the objectives outlined in the client’s individual Investment Policy Statement and Investment Management Agreement specific to the funds that each PM is managing.

We report to and answer to our clients to ensure that the client’s stated objectives are being adhered to so that they can reach their stated goals within their stated time horizon. Our primary responsibility is to educate our clients about the fundamental principles of prudent investing and then to present the leading solutions available without any bias or prejudice.

We will meet with you to review your existing investment portfolio and provide you with a written report for you to take away and consider that will outline exactly what you are paying in investment fees and how you can make simple switches to reduce your fees so that you can keep more money for yourself and your family. We will provide written recommendations that will allow you to provide a more effective and efficient diversification designed to reduce the risk you are taking while increasing the net returns on your investments.